Title: The economics of Trudeau's carbon tax

Post by: Anonymous on April 06, 2019, 07:39:47 PM

Post by: Anonymous on April 06, 2019, 07:39:47 PM

But then there's the substitution effect. Even suppose we compensate you for the effective decline in your income, as roughly, Ottawa is trying to do with its carbon tax rebates. You will be unlikely, given the new higher price for whatever good we're talking about, to consume exactly the same amount of it as before. More than likely, you'll consume less of the now higher-priced good and more of other things.

This is very basic economics. It gets taught in the first couple of weeks of any introductory microeconomics course. You won't find many economists, not even conservative ones such as myself, arguing with it. It would be like a mathematician arguing with basic arithmetic. Anyone who does argue with it—party leaders beware!—will look economically illiterate.

So it would be good if opponents of the new carbon tax focused on other possible problems with it, such as:

Global warming isn't that serious a problem or, if it is, it's best adapted to, rather than resisted.

Global warming is a global "public bad" and Canada's carbon tax will have only minimal global effect if other countries free-ride—as people can and often do when goods or bads are technologically "public," i.e. can be consumed even by people who don't pay for them.

The organization that brought us the Phoenix pay system may not be able to administer the new tax—or any tax—efficiently.

The new tax revenues eventually inevitably will stop being rebated and will instead be merged into consolidated revenue funds to provide ever more low-net-return public programs designed to make moral statements rather than solve real problems (though that would actually increase their carbon-reducing effect as it would add a negative income effect to the planned substitution effect).

Calculating the optimal level for the carbon tax—which in theory is the damage done at the margin by the activity being taxed—is hopelessly complicated so we'll never ever be sure we're getting it right.

It might well be better for the economy to use carbon tax revenues to cut taxes on income, investment and labour rather than to give cash rebates.

I could go on. It's certainly OK to challenge the carbon tax as a piece of public policy. It's eminently challengeable. But best not do it by denying simple truths about the price system. Especially if, in other areas, you cast yourself as a fan of the price system.

Fight it, fight it, fight it.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 06, 2019, 07:43:43 PM

Post by: Anonymous on April 06, 2019, 07:43:43 PM

Just a quick question for the Trudeau government about its current tiff with the Saudis: If you're serious about standing up to Riyadh, how come you are stilling giving their oil a free pass? How come you have exempted it from your upcoming carbon tax and are not subjecting Saudi oil to the same environmental regulations you have imposed on Western Canadian oil?

It couldn't be because most Saudi oil is destined for Quebec?

You're supposed to be in a battle with the Saudis, yet an objective outside observer might think you're at war with Alberta, instead.

There are a lot of questions that could be asked of the Liberals over the fight they started with the Saudis.

For instance, while there is no doubt the Saudis have overreacted (big time), there is equally no doubt Liberal cabinet minister Chrystia Freeland started this row by sending out a couple of self-righteous tweets last week criticizing the Saudis for recent arrests of human rights activist.

This was nothing more than moralistic grandstanding by the Liberals. They ignored proper diplomatic channels and don't seem to have planned to follow-up their social media sanctimoniousness by having our diplomats in the kingdom file formal complaints.

The Liberals simply launched a couple of fire-and-forget missiles, with no thought of how the Saudis might react, just to prove to people in Canada how hip and high-minded they are. Changing Saudi human rights policy was never their intention.

Freeland and the Liberals are right about the substance of their complaint. Saudi Arabia should release noted rights advocate Samar Badawi, who has been imprisoned for her political views. But if they really wanted Badawi freed, a pair of holier-than-thou tweets was never going to do it.

So one of the other questions the Liberals could be asked is: How are your thoughtless-bravado tweets any different from Donald Trump's? Your tone might be more sophisticated than the U.S. President's, but you both set off international incidents by not thinking before you message.

Still, the most important question is my first one: How come in the middle of a trade spat with the Saudis, Ottawa isn't even imposing the same taxes and regulations on Saudi oil that it imposes on Alberta, Saskatchewan and Newfoundland oil?

It looks as if, a) the Liberal government isn't serious about standing up to the Saudis and b) they aren't serious about their own campaign to reduce emissions and save the planet.

Canada produces about 3.8 million barrels of oil a day. We consume about 1.8 million or 1.9 million, but we export around 2.7 million barrels a day.

Most days that leaves us about 700,000 or 800,000 barrels short, an amount we have to import from the U.S., the Saudis, Nigeria and a handful of other countries.

We have more than enough capacity to supply all our own domestic needs and still export nearly 3.0 million barrels a day. What we lack are pipelines that would enable us to get Canadian oil to Quebec and the Maritimes.

That leaves us dependent on Saudi oil even when we have a valid diplomatic point to make.

The second part, though, is perhaps an even bigger puzzle: If the Liberals are so intent on cutting Canadians' emissions by imposing a new carbon tax and by creating impossible new environmental standards for the approval of new pipelines, how come they let foreign oil enter the country without subjecting it to the same "green" taxes or the same environmental screening processes?

Keep in mind, too, that Liberals let millions of tonnes of American coal come into Canada for export to the rest of the world without imposing a carbon tax, either.

The short answer is: The Liberals aren't a serious government. They're nothing more than intellectually lightweight virtue-signalers.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 06, 2019, 08:08:20 PM

Post by: Anonymous on April 06, 2019, 08:08:20 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 06, 2019, 10:31:21 PM

Post by: Anonymous on April 06, 2019, 10:31:21 PM

Trudeau is forcing poor people to decide to heat their homes or drive to work. Carbon taxes are another prog attack on blue collar working people.Quote from: "iron horse jockey"

The way our NDP government imposed it's carbon tax in Alberta, my family is subsidizing Syncrude and Suncor.

Title: Re: The economics of Trudeau's carbon tax

Post by: Gaon on April 06, 2019, 11:22:10 PM

Post by: Gaon on April 06, 2019, 11:22:10 PM

Trudeau is forcing poor people to decide to heat their homes or drive to work. Carbon taxes are another prog attack on blue collar working people.Quote from: "iron horse jockey"

The way our NDP government imposed it's carbon tax in Alberta, my family is subsidizing Syncrude and Suncor.

Can you explain that.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 07, 2019, 12:27:11 AM

Post by: Anonymous on April 07, 2019, 12:27:11 AM

Trudeau is forcing poor people to decide to heat their homes or drive to work. Carbon taxes are another prog attack on blue collar working people.Quote from: "iron horse jockey"

The way our NDP government imposed it's carbon tax in Alberta, my family is subsidizing Syncrude and Suncor.

Can you explain that.

I'll try Gaon..

Instead of taxing big emitters like the previous government did, she charges carbon to consumers, and then gives the money to big corporations like Syncrude and Suncor so they can invest in green technology.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 07, 2019, 02:19:07 PM

Post by: Anonymous on April 07, 2019, 02:19:07 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 07, 2019, 03:04:57 PM

Post by: Anonymous on April 07, 2019, 03:04:57 PM

The former Ontario Liberal government's green energy and carbon tax plans were a hit list on the most financially vulnerable people in the province. I would like to lower emissions as part of an overall conservation effort. But, forcing people at the bottom economic rungs of the ladder to choose between heat, electricity and some imported produce ought to be criminal.Quote from: "seoulbro"

Carbon sales taxes are ineffective and make families like mine poorer.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 07, 2019, 03:36:33 PM

Post by: Anonymous on April 07, 2019, 03:36:33 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 07, 2019, 05:22:00 PM

Post by: Anonymous on April 07, 2019, 05:22:00 PM

If carbon taxes were implemented the way economists prescribed it wouldn't be so bad. But, in no place that has a carbon tax has that happened.Quote from: "Velvet"

All I know is it takes money from my family and gives it to corporations.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 08, 2019, 03:53:18 PM

Post by: Anonymous on April 08, 2019, 03:53:18 PM

MANMADE GLOBAL WARMING – IS A THEORY OR HYPOTHESIS THAT LACKS EVIDENCE.

In order for there to be Global Warming there needs to be appreciable warming. According to NASA/NOAA the Earth has warmed 1.53 degrees F since 1880 or 137 years. Another theory is the so-called hockystick equation which predicts that a rise in CO2 will cause the Earth's temperature to rise exponentially. Again, according to NASA, The CO2 has gone up and the Earth's temperature has not and therefore this theoretical equation is proven wrong. All the theories have been proven to be without substance and yet we spend BILLIONS supporting so-called renewable sources of energy and killing, and driving up the prices, of our natural resources Coal, Oil and Gas.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 08, 2019, 04:43:57 PM

Post by: Anonymous on April 08, 2019, 04:43:57 PM

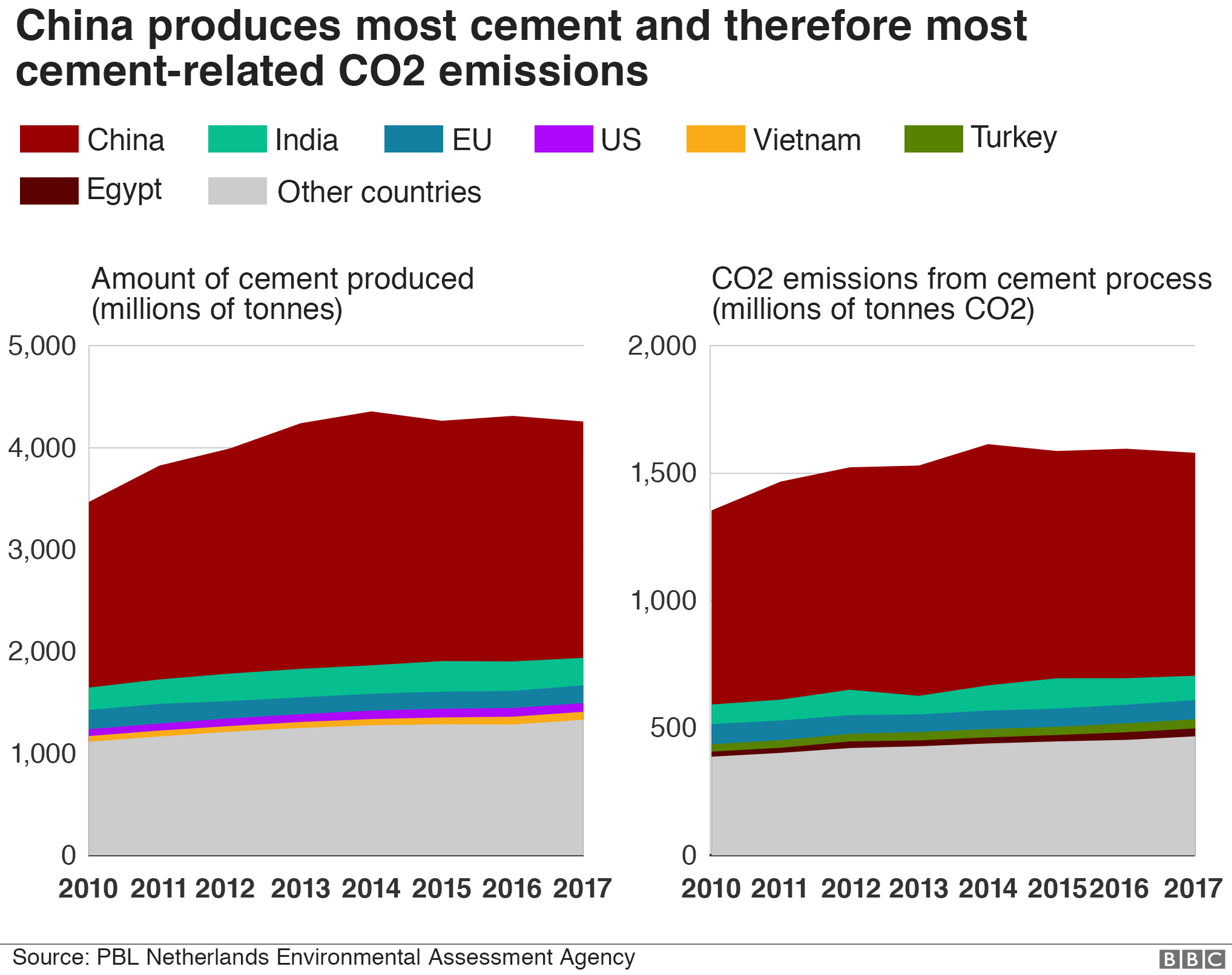

But, while cement - the key ingredient in concrete - has shaped much of our built environment, it also has a massive carbon footprint.

Cement is the source of about 8% of the world's carbon dioxide (CO2) emissions, according to think tank Chatham House.

If the cement industry were a country, it would be the third largest emitter in the world - behind China and the US. It contributes more CO2 than aviation fuel (2.5%) and is not far behind the global agriculture business (12%).

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 08, 2019, 08:25:22 PM

Post by: Anonymous on April 08, 2019, 08:25:22 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 10, 2019, 11:00:05 AM

Post by: Anonymous on April 10, 2019, 11:00:05 AM

Loblaw freezer grant slammed

It is safe to say the climate is heating up in Ottawa — and there's no debate about that.

Just one day after Loblaw Companies Ltd. received a commitment from the Liberal government for up to $12 million to make it's refrigeration systems more climate-friendly, the Canadian Taxpayers Federation is urging the grocery giant not to accept it.

"I don't think they should," said CTF Federal Director Aaron Wudrick. "It's a company that doesn't need taxpayers to pay for this. It would be impressive if they decided to not (take it)."

Politicians have been all over Prime Minister Justin Trudeau and, specifically, Environment Minister Catherine Mckenna for ever thinking of the idea.

NDP MP Charlie Angus tweeted: "(Loblaw owner) Galen Weston is worth $13.55 billion and Catherine Mckenna showed up at one of his stores to give his company $12 million — after being found guilty of price fixing bread prices. SNC, KPMG, Kinder Morgan — Justin Trudeau's idea of the needy."

While Canadians are being hit with a new carbon tax in the name of fighting climate change, Loblaw, owned by Canada's second wealthiest family, is getting paid with tax dollars to beef up its environmental efforts.

"It's madness," said Wudrick. "It's also not right."

Part of the reason is Loblaw has not always been an ideal corportate citizen. The company fessed up in 2017 to its role in a 14-year bread price fixing scheme which resulted in the grocer trying to make amends by handing out $25 gift cards to customers.

"We recorded a charge of $111 million in relation to the Loblaw card program," a Loblaw spokesman said Tuesday.

Just last year, the Tax Court of Canada — as reported by The Canadian Press — ruled Loblaw Companies Ltd. recorded a "$368-million tax charge" in a dispute over money being effectively shielded by it's Barbadian banking subsidiary, Glenhuron Bank Ltd. The company is appealing the decision.

As for the $12-million federal climate change grant, the Loblaw spokesman explained the "funding comes from our application to the Low Carbon Economy Fund in 2018, which is open to businesses, hospitals, cities and others aiming to reduce carbon pollution."

The renovations "adds to our company's investmentment of $36 million to reduce refrigerant emissions and will result in the equivalent carbon reductions of taking 50,000 cars off the road annually. Our range of carbon-reduction investments is over $100 million as we work to reduce our carbon footprint by 30% by 2030."

These are admirable pursuits, but when a company boasts more than

$11 billion in revenue and profit to shareholders of more than $750 million, it's not hard to see why regular taxpayers can't understand why they are being dinged at the pumps while this rich firm gets public assistance.

Wudrick is right. This break to Loblaw is both obscene and offensive.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 10, 2019, 05:17:13 PM

Post by: Anonymous on April 10, 2019, 05:17:13 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 11, 2019, 11:45:34 PM

Post by: Anonymous on April 11, 2019, 11:45:34 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 12, 2019, 09:03:39 AM

Post by: Anonymous on April 12, 2019, 09:03:39 AM

(//%3C/s%3E%3CURL%20url=%22https://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%22%3E%3CLINK_TEXT%20text=%22https://scontent.fyxd1-1.fna.fbcdn.net/%20...%20e=5D46D35A%22%3Ehttps://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%3C/LINK_TEXT%3E%3C/URL%3E%3Ce%3E)

It probably does reduce emissions marginally on the backs of working families..

Anytime you raise prices rapidly people will consume less..

But, forcing people to choose between heating their homes, electricity and driving to work is amoral.

And, as we've seen in Alberta and federally it is a cash giveaway to big companies.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 12, 2019, 10:49:44 AM

Post by: Anonymous on April 12, 2019, 10:49:44 AM

(//%3C/s%3E%3CURL%20url=%22https://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%22%3E%3CLINK_TEXT%20text=%22https://scontent.fyxd1-1.fna.fbcdn.net/%20...%20e=5D46D35A%22%3Ehttps://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%3C/LINK_TEXT%3E%3C/URL%3E%3Ce%3E)

It probably does reduce emissions marginally on the backs of working families..

Anytime you raise prices rapidly people will consume less..

But, forcing people to choose between heating their homes, electricity and driving to work is amoral.

And, as we've seen in Alberta and federally it is a cash giveaway to big companies.

You are getting it Fash. There are so much more efficient ways of reducing emissions at home and abroad besides asking the poor to subsidize the rich.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 12, 2019, 11:53:16 AM

Post by: Anonymous on April 12, 2019, 11:53:16 AM

(//%3C/s%3E%3CURL%20url=%22https://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%22%3E%3CLINK_TEXT%20text=%22https://scontent.fyxd1-1.fna.fbcdn.net/%20...%20e=5D46D35A%22%3Ehttps://scontent.fyxd1-1.fna.fbcdn.net/v/t1.0-9/56381618_786208451754434_3352130646343417856_n.jpg?_nc_cat=101&_nc_eui2=AeGXpk9uek_OXDICvnkE2RoFr5CKFQXzzAyK1zFQcXlQnEZ-v-JxGilS_gAfYYw9Nc6CAM_jefe8DXVhni2oj1mbEgrL1IT-m1fNVHP-af4g8A&_nc_ht=scontent.fyxd1-1.fna&oh=0aaedbea665bee45cbc1da105c4f2478&oe=5D46D35A%3C/LINK_TEXT%3E%3C/URL%3E%3Ce%3E)

It probably does reduce emissions marginally on the backs of working families..

Anytime you raise prices rapidly people will consume less..

But, forcing people to choose between heating their homes, electricity and driving to work is amoral.

And, as we've seen in Alberta and federally it is a cash giveaway to big companies.

Title: Re: The economics of Trudeau's carbon tax

Post by: Gaon on April 19, 2019, 11:13:24 PM

Post by: Gaon on April 19, 2019, 11:13:24 PM

How come in the middle of a trade spat with the Saudis, Ottawa isn't even imposing the same taxes and regulations on Saudi oil that it imposes on Alberta, Saskatchewan and Newfoundland oil?

The prime minister of Canada prefers OPEC oil over Canadian oil. So much so, he has decided to put Canadian oil at a competitive disadvantage.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 20, 2019, 07:56:26 AM

Post by: Anonymous on April 20, 2019, 07:56:26 AM

Trudeau Government Exempts Saudi Arabian Oil From Carbon TaxQuote from: "Gaon"

How come in the middle of a trade spat with the Saudis, Ottawa isn't even imposing the same taxes and regulations on Saudi oil that it imposes on Alberta, Saskatchewan and Newfoundland oil?https://capforcanada.com/trudeau-government-exempts-saudi-arabian-oil-from-carbon-tax/?fbclid=IwAR2OvEes5ROq-dzeJtbbRVOECwqybqc7gUkHHDsC6sVlTLCyZEFc5xpWSU0

The prime minister of Canada prefers OPEC oil over Canadian oil. So much so, he has decided to put Canadian oil at a competitive disadvantage.

Most Canadians must not be aware that the eight hundred thousand barrels of oil Eastern Canada imports everyday are carbon tax free unlike our own domestic energy.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 20, 2019, 09:11:21 AM

Post by: Anonymous on April 20, 2019, 09:11:21 AM

Trudeau Government Exempts Saudi Arabian Oil From Carbon TaxQuote from: "Gaon"

How come in the middle of a trade spat with the Saudis, Ottawa isn't even imposing the same taxes and regulations on Saudi oil that it imposes on Alberta, Saskatchewan and Newfoundland oil?https://capforcanada.com/trudeau-government-exempts-saudi-arabian-oil-from-carbon-tax/?fbclid=IwAR2OvEes5ROq-dzeJtbbRVOECwqybqc7gUkHHDsC6sVlTLCyZEFc5xpWSU0

The prime minister of Canada prefers OPEC oil over Canadian oil. So much so, he has decided to put Canadian oil at a competitive disadvantage.

Most Canadians must not be aware that the eight hundred thousand barrels of oil Eastern Canada imports everyday are carbon tax free unlike our own domestic energy.

Is Trudeau accepting holiday gifts from the Saudi royal family. He is the best thing that ever happened to OPEC and American oil producers.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 21, 2019, 03:13:01 PM

Post by: Anonymous on April 21, 2019, 03:13:01 PM

Provincial elections refute Trudeau's carbon tax claims

Elections in Alberta last week and Ontario last June mean Prime Minister Justin Trudeau and Environment Minister Catherine Mckenna have lost a key talking point in support of carbon pricing heading into the Oct. 21 federal vote.

Last year at this time, they were able to boast, as they did incessantly, that more than 80% of Canada's population (86% actually) lived in the four provinces that already had carbon pricing — Ontario, Alberta, British Columbia and Quebec.

But with the election of Premier-designate Jason Kenney and the United Conservative Party in Alberta, and Premier Doug Ford and the Progressive Conservative party in Ontario, that number has been turned on its head.

Today, most of Canada's population, 59%, lives in the five provinces — Ontario, Alberta, Saskatchewan, Manitoba and New Brunswick — that oppose Trudeau's carbon tax and are challenging it, or are about to, in court.

That means neither Trudeau nor Mckenna can now portray provincial governments opposed to their carbon tax/price as isolated hold-outs.

The fact is they now represent 50% of the provinces with almost 60% of Canada's population.

Many (although not all) legal experts believe the Trudeau government will eventually win the legal challenges against his carbon tax by the provinces opposing it.

But the fate of Trudeau's carbon tax won't be decided in the courts — given the lengthy time it will take to hear all the legal challenges and appeals — but in the Oct. 21 federal election, now exactly six months away.

Since Conservative leader Andrew Scheer has promised to abolish Trudeau's carbon tax, it will be dead on arrival if he wins a majority government.

If Trudeau wins a majority government on Oct. 21 (or a minority where he can obtain enough support from the opposition parties) his carbon tax will forge ahead.

At that time we'll presumably learn, since he's not telling us now, how much higher he plans to hike his carbon tax — currently at $20 per tonne of industrial greenhouse gas emissions, rising to $50 per tonne in 2022 — after 2022. Since the federal government has repeatedly hinted at imposing more "stringent" carbon taxes on Canadians post-2022, Trudeau should tell us going into the Oct. 21 election how much higher he intends to boost his carbon tax after 2022. For one thing, if he wins the election, he'll be in power until 2023. Surely, if it's true that, as Trudeau claims, his carbon tax is going to make most Canadian households in the provinces where he's imposed it richer because of its rebate provisions, that shouldn't be a problem. Because if Trudeau's carbon tax is going to leave most of us better off financially, surely the higher the carbon tax he imposes, the better off we'll be, right?

Back in the real world, if Trudeau's carbon tax is going to be a major issue in the Oct. 21 election — as some pollsters say it will be — then it will be one fuelled by political rhetoric rather than reality.

Everyone who's looked at the numbers knows Trudeau's current carbon price/tax isn't going to achieve the commitments he made to the international community to reduce Canada's emissions to 17% below 2005 levels by 2020 and to 30% below 2005 levels by 2030.

All Trudeau's carbon tax really is, is virtue signalling.

It's only actual virtue will be — if one considers it a virtue — that it will reduce emissions more than Scheer's plan, which we haven't even seen yet.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 23, 2019, 12:35:07 PM

Post by: Anonymous on April 23, 2019, 12:35:07 PM

In 1965 a group of scientists presented a report to US President Lyndon Johnson warning that pollution could cause us trouble.

The Environmental Pollution Panel report cautioned "that continued accumulation of atmospheric carbon dioxide resulting from fossil-fuel burning would 'almost certainly cause significant changes' and 'could be deleterious from the point of view of human beings.'"

Both authors of this column were too young to know much about this. But a few years later Johnson was noting the Stop The Spadina Expressway movement in Toronto, and Bonner was playing small roles in protesting pollution during the heady days in Vancouver when Greenpeace was being founded. In Vancouver, the talk was about soft drink cans under the polar ice caps, sea levels rising, the "greenhouse effect" and just plain litter everywhere. In Toronto it was better gas mileage and fewer cars downtown. Both authors remember refuse along the Trans-Canada Highway, mile after mile.

Controversial President Richard Nixon had a practical solution. In his State of the Union Address in 1970, he said, "We can no longer afford to consider air and water common property, free to be abused by anyone without regard to the consequences. Instead, we should begin now to treat them as scarce resources, which we are no more free to contaminate than we are free to throw garbage into our neighbor's yard. This requires comprehensive new regulations. It also requires that ... the price of goods should be made to include the costs of producing and disposing of them without damage to the environment."

LBJ, Nixon, scientists, Greenpeace, the anti-freeway movement — none of them ever suggested allowing polluting rivers, the air, and ground for a fee. Fines, jail terms, and public flogging perhaps, but not paying to pollute.

We've made some progress, but haven't really tried out all the 3 Rs — Reduce, Re-use, and Recycle. We recycle perfectly good glass bottles, but isn't that nutty when we should re-use them for their entire expected life of 20 refills? We've not figured out what to do with electric cars, which may be a nuisance to recycle and which don't pay their fair share in taxes to use the roads. We fret about a way to pick up tons of plastic garbage from the oceans, but nobody has the guts to ban plastic bottles.

And that brings us to cap and trade, carbon taxes, and carbon pricing. Whatever it's called, isn't it a license to pollute? By what right (as Richard Nixon might say) does a polluting company pay a non-polluting company to keep polluting?

And will a carbon tax work? Advocates say that gas going up 5 cents a litre will cause consumers to make better environmental decisions. Really? What about the last 50 years of increases in gas prices? They coincide with our generation buying gas-guzzling SUVS. Do we really think this increase in price will cause a shift away from small gasoline engines, used in landscaping, which cause up to 20 per cent of urban air pollution?

The distance between the economic dis-incentive (5 cents a litre) and the desired human behaviour (switching to hand clippers or small cars) is too far apart. Plus the dis-incentive is too small.

The solution is in plain sight. Use Richard Nixon's formula — regulation, legislation, and full production and recycling without harm to the environment. Dale Johnson and Allan Bonner are award-winning journalists who have consulted to heads of government,

environmental groups, and senior private sector leaders on some of the major public policy issues of our times, including acid rain, crossborder pollution, the Rio Conference, NAFTA, overfishing, European Union, and a host of other issues.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 24, 2019, 10:54:49 AM

Post by: Anonymous on April 24, 2019, 10:54:49 AM

Back in 2011, the Supreme Court of Canada nixed a proposed project by former prime minister Stephen Harper. The Conservatives wanted to create a single national securities regulator, but the Supreme Court preferred the provinces' own securities regulators over Harper's federal one. Their reasoning? Because Section 92 of the Constitution Act, 1867 gives the provinces the exclusive jurisdiction over property and civil rights within their provinces, i.e. the regulation of the activities of their provincial companies and businesses.

There's a lesson in this for the Liberal government and their bid to save the national carbon tax. During a recent CTV Question Period appearance, Liberal Environment and Climate Change Minister Catherine McKenna bluntly stated that if Saskatchewan's Premier Scott Moe, Ontario's Doug Ford and Alberta's Jason Kenney pursued legal action against the Liberals' proposed national carbon tax legislation they'd lose in court.

McKenna provided no constitutional basis for this claim. It could end up being the case that Supreme Court of Canada will ultimately decide that the Liberals' proposed carbon taxation legislation is unconstitutional for the same reason it nixed Harper's securities regulator ― because it is an infringement on the provinces' exclusive jurisdiction over property and civil rights within their own provinces.

Section 91 of the Constitution Act sets out the subject matters over which the federal government has jurisdiction. There is no specific reference to the federal government having exclusive jurisdiction over the regulation of the entire Canadian environment.

Then, under Section 92, with respect to environmental issues, the provincial governments have jurisdiction over: Property and civil rights in the province, which gives the power to the provinces to regulate most companies, businesses, commercial activities and industrial activities within the provinces. It follows that such power includes regulating the emissions from such activities.

Likewise, when it comes to management of provincial Crown lands the power is given to the provinces to regulate mining and lumber activities and accordingly the emissions from such mining and lumber activities. The provinces are also responsible for all matters of a local or private nature within that province.

In determining whether the Liberals' proposed carbon tax legislation is constitutional, the Supreme Court will look at the pith and substance of the legislation, in other words the actual purpose and effects of this legislation.

The Trudeau government will likely argue that its proposed legislation is constitutional because the federal government alone has the federal jurisdiction to regulate the entire Canadian environment, not the provinces.

They'll also likely argue that in fulfilling its purpose to regulate the environment, it has the power to regulate all commercial and industrial activities in Canada, which includes imposing a carbon tax regime on such activities. By imposing this carbon tax regime, the effect of this policy will be to reduce greenhouse gas emissions in Canada, moderate climate change and hence improve the entire Canadian environment.

The problem with this argument is that the provinces, according to Section 92 of the Constitution, have the exclusive jurisdiction to regulate the activities of the companies and businesses in their provinces.

Ontario, Alberta and Saskatchewan may be able to successfully argue that the actual effects of the Liberals' proposed carbon tax legislation is the imposition of carbon taxes which will have no effect on positively affecting climate change and regulating the environment. Such carbon taxes, on the other hand, will make these provincial businesses non-competitive, unnecessarily increase their costs, and force them out of business with the resulting loss of jobs and investment.

McKenna shouldn't act so certain that a legal showdown with Moe, Ford and Kenney will end in her government's favour.

Mitch Wolfe, a graduate of University of Toronto Law School, is a commentator and analyst and author of Trump: How He Captured The Trump White House.

I am not confident at all the legal challenge against Trudeau's carbon sales tax will work. The surest way to get rid of it, is to get rid of Trudeau.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 24, 2019, 11:49:59 AM

Post by: Anonymous on April 24, 2019, 11:49:59 AM

In recent eco-news, Canada's Ecofiscal Commission, a self-appointed group that pushes pollution-pricing (believing that such mechanisms are superior to regulatory approaches), recently released a report called "10 Myths about Carbon Pricing in Canada."

As an answer to criticisms of the Trudeau government's carbon-pricing plan, it falls short.

Why? Because it spends too much time responding to claims no one is making, or to strawman versions of legitimate concerns, while avoiding discussing the substantive criticisms.

Due to space constraints, I'll focus on two of their "myths" that are not so mythical.

Ecofiscal's Myth No. 6 is that "Carbon Pricing is a Cash Grab."

This is "myth" because Ottawa will return all carbon-pricing revenue to the provinces, with 90% in lump sum rebates to households.

The rebate part is true, but the idea that the feds won't get a cut not. Ottawa will capture revenues from the increased GST collected due to higher prices caused by carbon taxes.

One estimate suggests the GST on top of the carbon price in 2019 could bring in $250 million in GST revenues, which will increase as the carbon tax escalates to $50 per tonne in 2022.

And of course, provinces with a Provincial Sales Tax will also see additional revenues, even if they also rebate all the revenue of the carbon tax itself.

Of course, provinces with existing carbon-pricing programs deemed equal to the federal backstop are under no such obligation to return all revenues, as we've seen in B.C., which abandoned revenue neutrality five years into its carbon tax.

According to Ecofiscal's Myth No. 9, it's a myth that "we can use other, better policies to shrink our emissions."

For evidence, the authors construct a false comparison.

They argue carbon pricing is more efficient than traditional regulations — but they don't address the problem, that the government is not replacing regulations with a carbon tax, but is adding the tax on top of regulation.

Here, Ecofiscal really fails in its mandate.

While they advocate for carbon pricing, they ignore the fact that by maintaining and expanding its regulatory reach, the government is eliminating the conditions that make for an efficient carbon price.

As analysis shows, none of the provinces that implemented carbon pricing did so in lieu of regulations.

And after implementing its federal carbon price, the Trudeau government plans to apply a "Clean Fuel Standard," which would "incent the use of a broad range of low carbon fuels, energy sources and technologies, such as electricity, hydrogen, and renewable fuels" and "establish lifecycle carbon intensity requirements separately for liquid, gaseous and solid fuels" and "not differentiate between crude oil types produced in Canada or imported" and "complement the pan-canadian approach to pricing carbon pollution."

Some optimistic (and no doubt well-meaning) economists tout the "grand bargain" of exchanging regulations for carbon pricing.

I have heard this argument since I started studying climate policy in 2006.

But in more than 20 years studying climate policy in the U.S. and Canada, I have never seen such a bargain put on the table because environmentalists don't want a grand bargain. They don't want to bargain, period.

They want all-of-the above — eco-justice, fuel standards, vehicle standards, building standards, green-power spending and a carbon tax.

From an efficiency standpoint, that's pretty much the worst climate option on the table.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 26, 2019, 11:55:32 AM

Post by: Anonymous on April 26, 2019, 11:55:32 AM

By Lorrie Goldstein of Sun News Media

Trudeau's carbon plan to collect annually by '23

TORONTO — Ottawa's non-partisan parliamentary budget office has finally given Canadians some independent numbers on the impact of Prime Minister Justin Trudeau's carbon tax on the four provinces — so far — where he's imposed it.

The report by economic analyst Nasreddine Ammar says carbon pricing will raise taxes $2.63 billion this year in Ontario, Saskatchewan, Manitoba and New Brunswick, rising to $6.21 billion in 2023-24.

Most of that money will come from the impact of the carbon tax on gasoline for residential and business use, home heating fuels and electricity rates — $2.43 billion this year, rising to $5.77 billion in 2023-24.

The rest will come from indirect charges paid by industrial emitters that will eventually be passed along to consumers in higher retail prices.

The lion's share of the money, over 75%, will be paid by consumers living in Ontario, the largest province, although households in Saskatchewan will incur the highest annual costs because of its intensive use of fossil fuel energy.

The PBO report also provides an independent analysis of whether the carbon tax's rebate system will leave consumers better or worse off financially.

It estimates most households in the four provinces will receive more in annual rebates than they pay in carbon taxes, except for the top 20% (based on income) in Ontario, Saskatchewan and New Brunswick, who will pay more in carbon taxes than they receive in rebates.

For those households, costs are predicted to exceed rebates in Ontario by $45 annually starting in 2019-20, rising to $99 annually in 2023-24.

In Saskatchewan, top-earning households will pay $50 more annually in 2019-20 rising to $113 annually in 2023-24, and in New Brunswick, $13 more annually in 2019-20 rising to $14 in 2023-2024.

Because part of the carbon tax rebate depends on volatile export markets, the PBO developed an alternative scenario in which only total household costs are returned to consumers as rebates, excluding the export portion from the incentive payments.

Under that scenario, the top 40% of households by income would pay more in carbon taxes than they receive in benefits in Ontario and New Brunswick, while the top 20% would pay more in Saskatchewan and Manitoba.

In this example, the costs of the carbon tax not covered by rebates in Ontario would be anywhere from $19 annually in 2019-20 to $188 annually in 2023-24, for higher-earning households.

In New Brunswick the range would be from $17 more in 2019-20 to $114 in 2023-24; in Saskatchewan from $73 more in 201920 to $142 in 2023-24 and in Manitoba, from $41 in 2019-20 to $91 in 2023-24.

These estimates presume Trudeau will honour his promise to keep his carbon tax revenue neutral and that his carbon price for industrial greenhouse gas emissions remains on its current schedule, rising from $20 per tonne of emissions this year to $50 per tonne in 2022-23.

Trudeau hasn't said what he plans to do with his carbon price after that, although his government has talked about increasing the "stringency" of the carbon tax post 2022-23.

Trudeau will also impose his carbon tax on the Yukon and Nunavut in July 2019, and could soon be doing it in Alberta as well, if Premier-designate Jason Kenney's United Conservative Party scraps defeated NDP premier Rachel Notley's carbon tax, as Kenney vowed he would during the recent Alberta election.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 26, 2019, 03:25:01 PM

Post by: Anonymous on April 26, 2019, 03:25:01 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 28, 2019, 12:21:58 PM

Post by: Anonymous on April 28, 2019, 12:21:58 PM

Saying carbon tax 'revenue neutral' just false

Before you accept Prime Minister Justin Trudeau's claim his carbon tax is going to make almost everyone richer, you might want to factor in that you'll be paying the federal goods and services tax (GST) on top of it.

And that this will pour hundreds of millions of additional dollars into federal coffers from Canadian taxpayers annually, despite Trudeau's claim his carbon tax is "revenue neutral" for his government.

It isn't, as the federal Conservatives have pointed out.

Because the 5% GST is applied to a broad range of goods and services after all other taxes and prices have been included, it will also apply to Trudeau's carbon tax, as a tax on a tax. (Or, in some cases, a tax on a tax on a tax.)

The same is true for provincial sales taxes, when it comes to assessing the full impact of Trudeau's carbon tax of $20 per tonne of industrial greenhouse gas emissions this year, rising to $50 per tonne in 2022 and after that, if Trudeau wins re-election on Oct. 21, who knows?

For Ontario households, that means in calculating the true cost of Trudeau's carbon tax on us, we have to add on the 13% HST (5% GST, plus 8% provincial sales tax) to it, for gasoline, natural gas and many other goods and services.

Ironically, the Ontario government is also getting increased revenue from Trudeau's carbon tax, which Premier Doug Ford, who's challenging Trudeau's carbon tax in court, doesn't want.

A report by the federal Parliamentary Budget Office last week which said Trudeau's carbon tax would raise $2.63 billion this year, rising to $6.21 billion annually in 2023 in the four provinces where he has imposed it — Ontario, Manitoba, Saskatchewan and New Brunswick — did not include the impact of the GST or provincial sales taxes in the costs to the public.

Since the GST applies to fossil fuels, such as gasoline, diesel and natural gas, which will generate the lion's share of carbon tax revenues in these four provinces ($2.4 billion this year, rising to $5.77 billion in 2023), it's obvious the impact on household budgets of the GST alone will be huge.

The Parliamentary Budget Office itself reported in December 2017 that the 5% GST would rake in a total of $501 million-$580 million for the Trudeau government for the 2017-18 and 2018-19 fiscal years, just in the four provinces that at that time had carbon pricing — Ontario, Alberta, British Columbia and Quebec.

With Trudeau's federal carbon tax/price scheme now almost fully in place across the country, the 5% GST is going to be worth billions of dollars in increased revenues to the feds over time.

The other significant effect of the GST/HST being applied to carbon pricing is that it will impact on Trudeau's claim most Canadians will come out ahead because of the federal carbon tax rebate system.

In some cases, the margins between what the Trudeau government says Canadians will pay in carbon taxes and what they'll get back in rebates is already thin.

Once you factor federal and provincial sales taxes being applied to carbon pricing to evaluate its true costs to Canadian households, those margins will be even thinner.

In some cases, Canadians who the Trudeau government says will be getting more money in rebates than they spend on carbon taxes, will be getting less.

Something Trudeau & Co. would prefer you to not think about.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 28, 2019, 12:33:19 PM

Post by: Anonymous on April 28, 2019, 12:33:19 PM

Our tax dollars shouldn't be used for partisan political advertising to win our votes or change our minds. But it is an election year in Canada, and apparently, our provincial politicians think it is OK to do so.

We are now seeing millions of wasted tax dollars spent on partisan "government" advertising about the carbon tax. Your tax dollars are being used to try and buy your support.

I don't know what makes me more upset when I have the radio on — having to listen to former Toronto Maple Leafs players succeeding with other Stanley Cup playoff teams or hearing the never-ending taxpayer-funded radio ads about the carbon tax in between periods.

Prime Minister Justin Trudeau was elected with a mandate to stop the spending of tax dollars on partisan advertising. The Stephen Harper government had continued the excessive expenditure on partisan government advertising that occurred in the Liberal government that preceded it.

In 2016 Treasury Board President Scott Brison introduced new rules to curb much of the partisan advertising by government. This was a step in the right direction. But the provinces haven't followed suit.

Former Ontario premier dalton Mcguinty addressed the practice of partisan, taxpayer-funded government advertising in 2004 by referring all such advertising for review to the provincially auditor general.

Ironically, his successor Kathleen Wynne reversed the partisan ban in 2015, and now Ontario Premier doug Ford is buying advertising like he is a guest star in a Mad Men episode.

Last month, Ford's government launched a massive taxpayer-funded advertising blitz attacking Trudeau's carbon-pricing plan.

It is on TV. It's on the radio. He has gone so far as to mandate gas stations post taxpayer-funded stickers that attack the Trudeau plan. But this waste of tax dollars isn't limited to Ontario.

Alberta Premier Jason Kenney campaigned on a promise to spend $20 million of Albertan's tax dollars fighting the Trudeau plan. More provinces are looking to follow their lead.

Any Premier has the right to fight the Prime Minister and do everything in their power to cause them to lose an election. But don't spend one dollar of my money doing it.

Talk to the traditional media for free and post your side of the story on social media — but don't put your hand in my pocket to pay for an ad campaign. It's a waste of my money.

Ford was elected on a mandate to stop the wasteful spending of Kathleen Wynne. One of his first acts as Premier should have been to restore the Mcguinty ad rules and reverse the terrible decision by Wynne.

Instead, he is acting precisely like Wynne and wasting our tax dollars.

Now we have dueling climate change plans from Ford et al. and Trudeau and all of us are stuck paying for partisan advertising instead of getting the services we deserve.

We need politicians to spend our tax dollars more wisely. We need a plan to deal with climate change. We need an honest election debate about this.

Our cities are congested with traffic and need new and improved infrastructure, public transit and highways. Our provinces need increased resources to fund a health care system facing a generational crisis. Our youth need improved access to education.

Our taxes pay for these things, which are the real pillars by which Canadians can move ahead economically and improve their quality of life.

Taxes should provide the government with the resources to give us the tools we need to create jobs and economic wealth, leading to more people earning more money and with that, a higher standard of living.

Conservatives and Liberals can both agree that our taxes should never be used for partisan advertising and buying our votes at election time.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 29, 2019, 08:30:19 PM

Post by: Anonymous on April 29, 2019, 08:30:19 PM

What is the point of the federal carbon pricing scheme? Or, more to the point, what does Prime Minister Justin Trudeau claim is the point of his beloved carbon tax?

"We're making big polluters pay, and giving the money right back to Canadians." Those are the exact words from a social media post by the PM from the other week. He's repeated this line almost verbatim many times before and there's good reason to believe he will again.

The idea is that the carbon tax is a sort of punishment for all the big, bad corporations out there that are thoughtlessly polluting our environment with their nasty emissions. The tax is then taken from those meanies and given to you, the little guy.

It's like a Robin Hood tax, except there's an added bonus – it magically cleans the environment at the same time. Who can dispute that?

There's a bit of a problem though.

It's not entirely accurate.

For starters, there is no way to confirm that the money a Canadian household has actually shelled out is equivalent to the amount they'll get back by claiming the rebate on their taxes.

"There is absolutely zero accounting done to determine how much we've actually paid in carbon pricing," Anthony Furey explained in a recent column.

The plot now thickens though thanks to a recent report from the Parliamentary Budget Officer on the costs and returns of the carbon tax.

Now, the PBO does endorse Trudeau's broad claim that the tax will leave some people better off. "The net benefits are broadly by income group," the report notes. "That is, lower income households will receive larger net transfers than high income households."

Although they do not address the issue of how this can be proven on a specific, individual level — because it can't.

More to the point though, they reveal it's not the case that the burden will be shouldered by "making big polluters pay".

They look at all the cash the carbon tax will rake in to federal coffers and calculate that "household consumption of energy and nonenergy products will generate threequarters of carbon pricing revenue."

Where's the money coming from? It's coming from you.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on April 30, 2019, 10:42:10 PM

Post by: Anonymous on April 30, 2019, 10:42:10 PM

The Trudeau Liberals are careful stewards of the environment and appropriately concerned about climate change. The Conservatives, by contrast, have no plan for the environment. Such is the narrative the Liberals are hoping to sell Canadians in the lead up to this year's federal election.

Many Canadians, however, aren't buying it. Behind the veil of thoughtful, pious environmentalism that the Liberals spent the last four years constructing, Canadians have found an expensive tax on carbon dioxide emissions that the federal government is battling five provinces to impose and an increasingly haphazard redistribution of wealth from taxpayers to rent-seekers.

The level of absurdity in Environment Minister Catherine Mckenna's recent declaration that a $12-million gift to Loblaw's was in the public interest rivalled that of a certain Mr. Snrub — identical in appearance, except for a mustache, to The Simpsons' energy baron Mr. Burns —cheerfully suggesting to Springfield residents at a town meeting that the government "invest" millions of dollars in the local nuclear plant.

The only difference is that Mr. Burns didn't get his taxpayer handout (Springfield built a monorail instead), but Loblaw's got their $12-million.

To be sure, there is nothing environmentally or economically irresponsible about energy efficient refrigeration. If Catherine Mckenna is for some reason determined to spend money on refrigerators to improve the environment for her fellow Canadians, that is excellent behaviour and should be applauded — as long as she is spending her own money, not everybody else's money.

The problem with government, as Milton Friedman said, is that "it's always so attractive to be able to do good at somebody else's expense." Many taxpayers disagree with Catherine Mckenna on the virtues of improving Loblaw's refrigerators. Indeed, the handout was too rich even for the NDP, though leader Jagmeet Singh's opposition to the corporate fridge giveaway was based more on the NDP'S hostility towards big business than saving taxpayers' money.

The do-goodery of Mckenna's handouts to Loblaw's is matched in wastefulness by new federal subsidies of up to $5,000 for the purchase of electric vehicles beginning in May. The standard estimate of economists is that these subsidies cost about $400 per tonne of greenhouse gas emissions reduced. By comparison, the federal carbon tax this year is $20 per tonne.

The uneconomic nature of such subsidies have made them a staple in the platforms of profligate governments, such as the former Ontario Liberal government, trying to buy votes from middleand upper-income households while appearing to be friends of the environment.

The hundreds of millions of dollars to be spent on electric vehicle subsidies are in addition to the many millions of dollars more for charging stations, corporate welfare for automobile manufacturers, and government agencies to help manufacturers get these vehicles to market.

Big federal climate dollars are also being poured into various programs which fund the green initiatives of provincial, municipal, and First Nation governments.

So in addition to paying for these green projects themselves, taxpayers also pay for the employment of provincial and municipal bureaucrats to write environmental grant applications, as well as the federal bureaucrats needed to approve the applications and dispense the funds.

This is a splendid way to oppress taxpayers and ensure environmental bureaucrats and corporate welfare recipients are able to capture a larger share of the national wealth. But like refrigerator subsidies and other Liberal initiatives rolled out under the banner of environmentalism, it more resembles counterproductive wealth redistribution than wise environmental policy.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 05, 2019, 12:20:32 PM

Post by: Anonymous on May 05, 2019, 12:20:32 PM

Environment and Climate Change Minister Catherine McKenna hasn't seemed too pleased on camera all that much recently.

But she was all smiles on Friday following the split decision by the Court of Appeal for Saskatchewan on the carbon tax case.

The court sided 3-2 with the federal government and against the Saskatchewan provincial government that the Trudeau Liberals do have the constitutional authority to force a carbon tax on provinces against their will.

Premier Scott Moe voiced his disapproval at this ruling by vowing to continue fighting it, pledging to appeal the ruling. There is a good chance that this issue will wind its way up to the Supreme Court of Canada.

In the meantime, the Liberal government and the climate alarmists who enable them are doing a victory lap over what they see as a big win for their cause.

Following the elections of Moe, Doug Ford in Ontario and Jason Kenney in Alberta, the Liberals were no doubt feeling against the ropes on this issue.

Now they feel they have a reprieve.

But they shouldn't celebrate for long. Because while the Court of Appeal has – just barely – sided with the feds, that doesn't mean public opinion will magically join them.

The carbon tax may for now be considered legal but that doesn't make it right.

McKenna used her time in front of the cameras to offer a gloating statement where she chastised the Premiers opposed to the carbon tax and called on them to drop their opposition and join her in the climate change crusade she's waging.

The minister has it backwards though. It's the Liberal government that needs to cut out the antics.

Prime Minister Justin Trudeau is only imposing the national carbon pricing backstop on provinces whose plans he doesn't like.

He's basically acknowledging that carbon taxes are a provincial issue and that they should be free to have their own plan – he'll just wade in if they're not doing what he wants.

This isn't a healthy way to govern. The entire approach by the Liberals on this issue is needlessly divisive.

Trudeau doesn't want to talk about other options because they don't bring in over half a billion bucks in GST revenues in the first year alone like a tax on a tax does.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 05, 2019, 12:26:59 PM

Post by: Anonymous on May 05, 2019, 12:26:59 PM

Now that Albertans have elected the United Conservative Party as their government, that brings the number of provinces fighting the carbon tax up to five.

Incoming Premier Jason Kenney will see his government join Ontario, Saskatchewan, Manitoba and New Brunswick in opposing the deeply unpopular tax.

A tipping point has been reached. With the population of Alberta tossed in to the mix, these five provinces now represent more than half the population of Canada.

You'd think this would be a wake-up call to Prime Minister Justin Trudeau. It's pretty simple math. If five provinces are trying to get out from under the yoke of the carbon tax, if leaders representing the majority of the people are opposing it, that should tell Trudeau and Environment Minister Catherine McKenna something.

That something is that this tax should be put aside, placed on hold, axed, finished, removed. It's a public policy mess. It's a political disaster. And so far it's been deeply divisive.

This week we had the Ontario court hearings into whether or not the feds have the right to impose this tax on the provinces.

That's the second such court process, after a previous one happened in Saskatchewan. Then there could be a contentious Supreme Court battle.

What is Trudeau thinking? This is tearing the country apart. The mature thing to do would be to back away from this plan.

But no, not Trudeau. And certainly not McKenna.

They dug in their heels after Kenney's promise to eliminate his province's version of the carbon tax. McKenna has already signalled that the feds will impose the national carbon pricing scheme on Alberta if necessary and that their plans will not be derailed.

Why though? Why the stubbornness? Why the inability or unwillingness to see the damage this is causing to the federation?

There are many ways to be responsible stewards of the environment and if some provinces don't care for the elaborate scheme that is carbon pricing, so be it.

The federal Liberals need to respect the provinces and respect the will of provincial voters.

Instead, they are acting like true believers who are willing to risk everything on imposing the carbon tax even if it leads to their downfall. And it very well may.

The majority of Canadians have shown they do not believe Trudeau's blatant revenue grab is how to adapt or slow climate change. Dictator Trudeau and his lieutenant McKenna refuse to listen.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 05, 2019, 12:41:39 PM

Post by: Anonymous on May 05, 2019, 12:41:39 PM

A big part of the sell around the federally mandated carbon tax that came into effect for four provinces on April Fool's Day is that it will somehow be profitable for Canadians.

It's the carrot the Liberals have been dangling to get Canadians to buy in to this whole scheme in the first place and we've heard this message on repeat.

"Starting today, we're making big polluters pay, and giving the money right back to Canadians – to keep our communities clean & healthy, and make your life more affordable," Prime Minister Justin Trudeau posted to social media.

A graphic the Liberal's have been sending around claims the tax "reduces pollution and puts more money in your pocket".

More money?! As in, more than you had before you were dinged by the tax? That's quite something.

But how is it going to happen? How do you prove it? Good question.

The way they talk about it and then bandy about the phrase "revenue neutral" it makes it sound like if you shell out, say, $782.67 in carbon tax fees throughout any given calendar year then you will get a full rebate of $782.67.

That's not how this work. Not at all.

The Climate Action Incentive, as they're calling it, isn't a complicated calculation at all. It's just one line on your income tax return, Line 449.

To claim it, you need to complete a one-page Schedule 14 on your tax return. (I'm now going to use the Ontario numbers below as an example, although they differ from province-to-province.)

An individual then claims the basic amount of $154. If you're married, you can claim a spouse to add $77. If you have kids, you get to add $38 per kids. If you live in a rural area, you increase your total rebate by 10%.

This is where the Liberals are getting the magic number of $307 for the average family of four that they've been shopping around.

Here's the thing though. The credit is the same for everyone.

If you're struggling to make ends meet, you'll get the $307. But if you're pulling in a big six-figure income, you'll also get the $307. It's the same for everyone.

And what does the rebate number have to do with how much you the individual has shelled out in carbon tax cash? It doesn't. There is absolutely zero accounting done to determine how much you've actually paid in carbon pricing.

It could be costing you less than $307 (which is what the Liberals hope you'll conclude) or it could be way, way more. The numbers they're working with are government estimates and they haven't disclosed the details of how they came to those figures.

Yes, we know the tax is going to raise the price of gas by about 4 cents per litre. What we don't know is how other emitters and producers are going to respond to their increased costs and to what degree they will pass them off to the consumer.

How then can you figure out on your own if this rebate actually has left you better off? You can't.

When the government first announced they'd be giving people their money back and then some, it left the impression that we'd somehow be tallying our receipts, like maybe from some carbon tax line item at the bottom of our bills alongside the other taxes, and then sending in the total to the taxman. That's not how it's happening at all.

The Liberals have made quite the claim with the carbon tax. A claim that we have absolutely no way of verifying.

First of all, even if everyone got back all the extra costs of Trudeau's carbon cash grab, how is that a disincentive to use less heat and gasoline. It's like refunding every dollar people pay in sin taxes on booze and cigarettes that are there in the first place to discourage smoking and drinking.

More importantly, Trudeau and McKenna are lying their asses off about everybody getting their carbon tax money back. A family of four living in a bedroom community of Toronto with a combined income of $120 will get $307 back. That would be likely less than half of what the carbon tax would cost them in the first year. And the tax goes from $20 to $50 per tonne by 2022. Everything about Trudeau's carbon cash grab are lies.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 05, 2019, 01:26:24 PM

Post by: Anonymous on May 05, 2019, 01:26:24 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 08, 2019, 07:42:16 PM

Post by: Anonymous on May 08, 2019, 07:42:16 PM

The first test, that provinces will be able to resist the new federal carbon tax, has concluded.

And opponents of the federal carbon tax have come away empty-handed.

In a split 3-2 decision, last week the Saskatchewan Court of Appeal found that the federal government has authority over greenhouse gas emissions.

Writing in the National Post, Andrew Coyne (with whom I often agree) said this decision is just wonderful — "a victory for the planet, federalism and the rule of law, not to say common sense."

If there was any chance that a federal carbon price could be levied according to optimal economic theory, I might agree with Coyne.

The problem is, as the Fraser Institute has repeatedly shown, the way that Canada has implemented carbon pricing flies directly in the face of what economic theory dictates for an efficient tax.

Let's start at the beginning. Much is being made of the fact that the federal carbon tax will be revenue neutral (it won't actually be fully revenue neutral, only 90% will be rebated).

And indeed, economic theory states that a carbon tax should indeed be revenue neutral.

But there's a caveat here — to offset the harm the carbon tax does to the economy, the tax revenues must be used to reduce existing distortionary taxes such as the personal income tax or the corporate income tax.

Rebating the revenues as lump sum rebates eliminates the opportunity to offset the harm of the tax by reducing other distortionary taxes.

Another explicit assumption about optimal carbon taxation is that it must be emplaced in lieu of regulations — not layered on top of them.

Layering a carbon tax on top of regulations makes the regulations even more economically damaging.

But the Trudeau government shows no indication that it's ready to make that trade.

In fact, the government plans to implement a "Clean Fuel Standard" that "would incent the use of a broad range of low carbon fuels, energy sources and technologies, such as electricity, hydrogen, and renewable fuels, including renewable natural gas.

"It would establish lifecycle carbon intensity requirements separately for liquid, gaseous and solid fuels, and would go beyond transportation fuels to include those used in industry and buildings."

That does not sound much like a swap of a carbon tax for regulations.

Finally, as a 2017 Fraser Institute study showed, no government in Canada has adopted or long-maintained a genuinely revenue neutral carbon tax that satisfies the conditions for pricing carbon efficiently while protecting the environment.

The Saskatchewan Court of Appeal decision has carbon tax aficionados celebrating.

The Saskatchewan suit will likely head to the Supreme Court of Canada, offering a slender reed of hope for carbon tax opponents.

Unfortunately for Canadians, having the case come down to "to tax or not to tax" obscures the fact that Canada's carbon taxes will not be the economically benign greenhouse gas control regime Canadians were promised.

It will be an economically damaging carbon tax that only extends federal control over emissions — control that's best utilized by provinces, which have specific knowledge of their economies and how their people would respond to incentives to lower greenhouse gas emissions.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 19, 2019, 12:13:45 PM

Post by: Anonymous on May 19, 2019, 12:13:45 PM

In provinces whose carbon pricing plans have the federal government's approval, the increase in gas prices is substantially smaller than those under the federal tax

OTTAWA — Carbon taxes have been applied unequally in different provinces, a new report from the Canadian Taxpayers Federation is pointing out, with some Canadians paying as little as half a cent more per litre of gas than they were before carbon pricing came into effect.

The federal carbon tax, which was rolled out in Ontario, Manitoba, Saskatchewan and New Brunswick on April 1, has added about 4.4 cents to the price of a litre of gasoline. The tax was applied to those four provinces because they refused to develop their own carbon prices, and is supposed to increase to 11 cents per litre by 2022.

But in other provinces whose carbon pricing plans have the federal government's approval, the actual increase in gas prices is substantially smaller than that. Both Newfoundland and Prince Edward Island have offset their carbon taxes by cutting existing provincial gas taxes, such that Newfoundlanders are now paying just 0.42 cents more per litre than they were before the carbon tax was levied, and Islanders are paying just one cent more. P.E.I. also plans to increase its carbon tax by just one cent per litre in 2020 — less than the federal backstop, which is expected to increase by 2.2 cents per litre next year — and it's not clear whether it will continue to increase past 2020.

Provinces that kissed Trudeau's ass were charged less than provinces that stood up to his virtue signalling tax grab.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 19, 2019, 04:56:08 PM

Post by: Anonymous on May 19, 2019, 04:56:08 PM

'Completely inconsistent': Carbon taxes applied unequally between provinces, new report says

In provinces whose carbon pricing plans have the federal government's approval, the increase in gas prices is substantially smaller than those under the federal tax

OTTAWA — Carbon taxes have been applied unequally in different provinces, a new report from the Canadian Taxpayers Federation is pointing out, with some Canadians paying as little as half a cent more per litre of gas than they were before carbon pricing came into effect.

The federal carbon tax, which was rolled out in Ontario, Manitoba, Saskatchewan and New Brunswick on April 1, has added about 4.4 cents to the price of a litre of gasoline. The tax was applied to those four provinces because they refused to develop their own carbon prices, and is supposed to increase to 11 cents per litre by 2022.

But in other provinces whose carbon pricing plans have the federal government's approval, the actual increase in gas prices is substantially smaller than that. Both Newfoundland and Prince Edward Island have offset their carbon taxes by cutting existing provincial gas taxes, such that Newfoundlanders are now paying just 0.42 cents more per litre than they were before the carbon tax was levied, and Islanders are paying just one cent more. P.E.I. also plans to increase its carbon tax by just one cent per litre in 2020 — less than the federal backstop, which is expected to increase by 2.2 cents per litre next year — and it's not clear whether it will continue to increase past 2020.https://nationalpost.com/news/politics/completely-inconsistent-carbon-taxes-applied-unequally-between-provinces-new-report-says

Provinces that kissed Trudeau's ass were charged less than provinces that stood up to his virtue signalling tax grab.

Provinces with Liberal premiers are charged less.

Title: Re: The economics of Trudeau's carbon tax

Post by: Gaon on May 20, 2019, 04:21:59 PM

Post by: Gaon on May 20, 2019, 04:21:59 PM

'Completely inconsistent': Carbon taxes applied unequally between provinces, new report says

In provinces whose carbon pricing plans have the federal government's approval, the increase in gas prices is substantially smaller than those under the federal tax

OTTAWA — Carbon taxes have been applied unequally in different provinces, a new report from the Canadian Taxpayers Federation is pointing out, with some Canadians paying as little as half a cent more per litre of gas than they were before carbon pricing came into effect.

The federal carbon tax, which was rolled out in Ontario, Manitoba, Saskatchewan and New Brunswick on April 1, has added about 4.4 cents to the price of a litre of gasoline. The tax was applied to those four provinces because they refused to develop their own carbon prices, and is supposed to increase to 11 cents per litre by 2022.

But in other provinces whose carbon pricing plans have the federal government's approval, the actual increase in gas prices is substantially smaller than that. Both Newfoundland and Prince Edward Island have offset their carbon taxes by cutting existing provincial gas taxes, such that Newfoundlanders are now paying just 0.42 cents more per litre than they were before the carbon tax was levied, and Islanders are paying just one cent more. P.E.I. also plans to increase its carbon tax by just one cent per litre in 2020 — less than the federal backstop, which is expected to increase by 2.2 cents per litre next year — and it's not clear whether it will continue to increase past 2020.https://nationalpost.com/news/politics/completely-inconsistent-carbon-taxes-applied-unequally-between-provinces-new-report-says

Provinces that kissed Trudeau's ass were charged less than provinces that stood up to his virtue signalling tax grab.

It seems to be common in big countries like Canada for the central government to pit regions against each other. Moscow does it too.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 29, 2019, 03:50:59 PM

Post by: Anonymous on May 29, 2019, 03:50:59 PM

Justin Trudeau and Catherine McKenna often claim to use 'facts' and 'science' to justify the hated carbon tax they're imposing on Canadians.

Yet, the actual facts, and the actual science shows a carbon tax in Canada is a total waste of time, and will do nothing about global emissions.

Take a look at the charts below shared by Bloomberg writer Noah Smith on Twitter, which destroy any possible justification for a carbon tax in Canada:

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on May 29, 2019, 03:54:17 PM

Post by: Anonymous on May 29, 2019, 03:54:17 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on June 04, 2019, 12:37:37 PM

Post by: Anonymous on June 04, 2019, 12:37:37 PM

Fossil fuel and green energy supporters are crying the blues over Prime Minister Justin Trudeau's energy and environmental policies.

Trudeau crows about winning a narrow three-to-two split decision of the Saskatchewan government's appeal of his Greenhouse Gas Pollution Pricing Act (GGPPA) that concluded putting a price on pollution is constitutional, but he neglects to mention not just any climate change plan works.

Trudeau's carbon tax faces more legal challenges by Ontario, Manitoba, Alberta and perhaps other provinces, and final review by the Supreme Court of Canada.

Meanwhile, Trudeau's failure to advance the effort to get Canada's fossil fuel resources to tidewater for sale to global markets, and his proposed legislation on the environmental review of energy projects, have fossil energy supporters upset.

By contrast, the federal Trans Mountain pipeline purchase, LNG subsidies, carbon dioxide emission exemptions for large emitters, the use of natural gas and so-called green energy food-based ethanol as "bridges" away from hydrocarbons has upset the greens.

The real problem is these incentives are costly, inefficient and focused in the wrong places, thereby precluding better industrial technologies and best environmental practices.

An April 2019 University of Chicago study found 30 U.S. state-level programs upped electricity prices as much as 17%, concluding: "The global experiences from carbon markets and taxes make clear that much less expensive ways to reduce CO2 are available right now."

For example, using a June 2017 joint Concordia University and Montreal Economic Institute study, "Subsidizing electric vehicles inefficient way to reduce CO2 emissions", as a benchmark, the new $5,000 federal battery vehicle subsidy will cost $200 per ton of emissions — 10 times the current federal carbon tax.

By contrast, producing ammonia (NH3) from natural gas causes 2% of global GHG emissions, and the 90% carbon tax exemption, along with additional exemptions from life cycle emissions, is much less expensive.

It puts the actual "price on pollution" at $4 per ton of emissions, compared to the current federal carbon tax of $20 per ton, rising to $10 per ton in 2022, when Trudeau's carbon tax will be $50 per ton.

The incremental cost of sequestering carbon in hydrocarbons when making ammonia is 15%, or about $30 per ton, declining in the next five years from nine to five times the cost of polluting under the carbon tax exemption.

In November 2015 "Energy Report" cited a Carnegie Mellon University study on the "Use of NH3 fuel to achieve deep greenhouse gas reductions from U.S. transportation."

It concluded aggressive implementation of Nh3-fueled vehicles to replace gasoline vehicles, would eliminate 96% of the annual light duty vehicle CO2 emissions projected for 2040, a 718 million metric ton CO2 reduction.

The same backwards situation in Canada exists with respect to the use of better waste remediation technologies for municipal liquid, solid and plastic waste we bury, burn or ship elsewhere.

The Japan Times reported in a June 2017 article that over 1,000 workers process 195 tons of waste plastic a day, making 175 tons of ammonia sold for industrial and medical uses.

In 2014, Washington, D.C., opened North America's first large-scale high-tech system to turn 1,500 tons of sewage a day into a safe, rich soil amendment and in 2024, Maryland's Washington Suburban Sanitary Commission will start production.

We need an honest and fair user pay "price on pollution" which includes all life cycle emissions with no exemptions, except for big improvements in state of the art technologies.

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on June 04, 2019, 04:48:21 PM

Post by: Anonymous on June 04, 2019, 04:48:21 PM

Title: Re: The economics of Trudeau's carbon tax

Post by: Anonymous on June 14, 2019, 03:02:42 PM

Post by: Anonymous on June 14, 2019, 03:02:42 PM

The latest warning comes from the non-partisan Parliamentary Budget Office (PBO).

According to the PBO, Canada will need to boost its carbon tax from $50 a tonne in 2022 to between $102 and $138 a tonne by 2030 if Canada is to meet its Paris Agreement targets on greenhouse gas emissions.

The difference between $102 and $138 a tonne is dependent on the state of the economy and the price of oil over the next 11 years.